Oh lordy, do we have a "Freeman" amongst us now?

TAXES ARE LEGAL.

HST IS LEGAL.

ALIENS DO NOT PROBE HUMAN ANUSES.

THE CIA/CASTRO DID NOT ASSASSINATE PRESIDENT KENNEDY.

9/11 WAS NOT AN "INSIDE JOB".

Posted 03 December 2013 - 09:19 AM

Oh lordy, do we have a "Freeman" amongst us now?

TAXES ARE LEGAL.

HST IS LEGAL.

ALIENS DO NOT PROBE HUMAN ANUSES.

THE CIA/CASTRO DID NOT ASSASSINATE PRESIDENT KENNEDY.

9/11 WAS NOT AN "INSIDE JOB".

Lake Side Buoy - LEGO Nut - History Nerd - James Bay resident

Posted 03 December 2013 - 09:25 AM

Oh lordy, do we have a "Freeman" amongst us now?

TAXES ARE LEGAL.

HST IS LEGAL.

ALIENS DO NOT PROBE HUMAN ANUSES.

THE CIA/CASTRO DID NOT ASSASSINATE PRESIDENT KENNEDY.

9/11 WAS NOT AN "INSIDE JOB".

Post of the year.

Crabbygit, shame on you if you are a freeloading tax evader. If you don't like being a part of society, make a mineral claim and build a cabin out in the woods.

Posted 03 December 2013 - 02:56 PM

Ok fellas, let's not make things personal.

crabbygit's points are valid. The history of taxation as presented by him/her are an interesting addendum to this discussion.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

Posted 03 December 2013 - 04:20 PM

crabbygit's points are valid.

It's a bogus claim that has no basis in law and has been refuted by the courts. Section 91 of the Constitution gives the federal government the power to raise money "by any mode or system of taxation".

In Canada, anybody can ask the courts to declare a law unconstitutional. Just one small footnote though - in all of the years of taxation in Canada no court has ever agreed with crabbygit's claims.

Posted 03 December 2013 - 06:12 PM

Post of the year.

Crabbygit, shame on you if you are a freeloading tax evader. If you don't like being a part of society, make a mineral claim and build a cabin out in the woods.

Edited by crabbygit, 03 December 2013 - 06:13 PM.

Posted 04 December 2013 - 08:35 AM

Posted 04 December 2013 - 08:36 AM

Ok fellas, let's not make things personal.

crabbygit's points are valid. The history of taxation as presented by him/her are an interesting addendum to this discussion.

Not trying to "make things personal" but there is utterly no validity to the points referenced above. One can hold the opinion that the earth is flat and the sun revolves around us in the sky pulled by a team of horses but it does not make it true nor should anyone be accused of "meanness" or "lack of sensitivity" for calling a spade a spade.

Lake Side Buoy - LEGO Nut - History Nerd - James Bay resident

Posted 04 December 2013 - 08:49 AM

Quite an attacking, abusive string of assumptions/statements and labels from some one who knows nothing about me.

Did your reality distortion field remove the word if from my post?

The basis of any society and the formation of a nation is based on the founding documents in many cases a constitution an instrument which contains the fundamental principles, rules, laws and edicts by which a government and citizens shall live by, once ratified by the people.

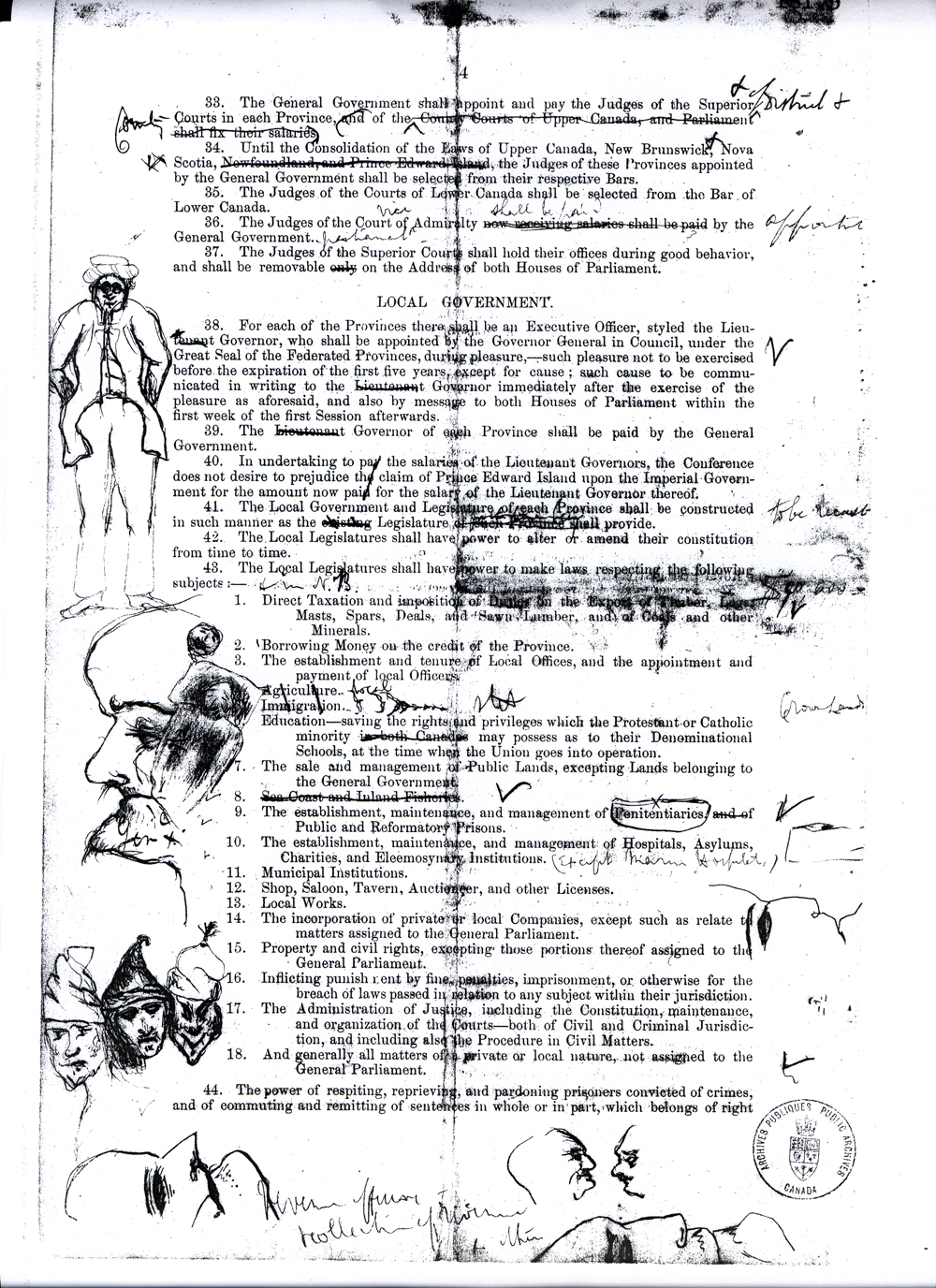

In Canada we have the BNA Act 1867 (regardless of subsequent amendments), the founding documents for the BNA Act as were written up in the Quebec resolutions in 1866 the "intent" of the founders on page 4 of those resolutions it clearly states at #43 The Local Legislatures shall power to make laws respecting the following subjects:-

The BNA Act of 1867 clearly gives the federal government the power of taxation in Section 91.

Powers of the Parliament.Legislative Authority of Parliament of Canada91. It shall be lawful for the Queen, by and with the Advice and Consent of the Senate and House of Commons, to make Laws for the Peace, Order, and good Government of Canada, in relation to all Matters not coming within the Classes of Subjects by this Act assigned exclusively to the Legislatures of the Provinces; and for greater Certainty, but not so as to restrict the Generality of the foregoing Terms of this Section, it is hereby declared that (notwithstanding anything in this Act) the exclusive Legislative Authority of the Parliament of Canada extends to all Matters coming within the Classes of Subjects next hereinafter enumerated; that is to say, --

- The Public Debt and Property.

- The Regulation of Trade and Commerce.

- The raising of Money by any Mode or System of Taxation.

- The borrowing of Money on the Public Credit.

- Postal Service.

- The Census and Statistics.

- Militia, Military and Naval Service, and Defence.

- The fixing of and providing for the Salaries and Allowances of Civil and other Officers of the Government of Canada.

- Beacons, Buoys, Lighthouses, and Sable Island.

- Navigation and Shipping.

- Quarantine and the Establishment and Maintenance of Marine Hospitals.

- Sea Coast and Inland Fisheries.

- Ferries between a Province and any British or Foreign Country or between Two Provinces.

- Currency and Coinage.

- Banking, Incorporation of Banks, and the Issue of Paper Money.

- Savings Banks.

- Weights and Measures.

- Bills of Exchange and Promissory Notes.

- Interest.

- Legal Tender.

- Bankruptcy and Insolvency.

- Patents of Invention and Discovery.

- Copyrights.

- Indians, and Lands reserved for the Indians.

- Naturalization and Aliens.

- Marriage and Divorce.

- The Criminal Law, except the Constitution of Courts of Criminal Jurisdiction, but including the Procedure in Criminal Matters.

- The Establishment, Maintenance, and Management of Penitentiaries.

- Such Classes of Subjects as are expressly excepted in the Enumeration of the Classes of Subjects by this Act assigned exclusively to the Legislatures of the Provinces.

And any Matter coming within any of the Classes of Subjects enumerated in this Section shall not be deemed to come within the Class of Matters of a local or private Nature comprised in the Enumeration of the Classes of Subjects by this Act assigned exclusively to the Legislatures of the Provinces.

The BNA Act then goes on to state (Section 92)

Exclusive Powers of Provincial Legislatures.

Subjects of exclusive Provincial Legislation92. In each Province the Legislature may exclusively make Laws in relation to Matters coming within the Classes of Subjects next hereinafter enumerated, that is to say,

- The Amendment from Time to Time, notwithstanding anything in this Act, of the Constitution of the Province, except as regards the Office of Lieutenant Governor.

- Direct Taxation within the Province in order to the raising of a Revenue for Provincial Purposes.

- The borrowing of Money on the sole Credit of the Province.

- The Establishment and Tenure of Provincial Offices and the Appointment and Payment of Provincial Officers.

- The Management and Sale of the Public Lands belonging to the Province and of the Timber and Wood thereon.

- The Establishment, Maintenance, and Management of Public and Reformatory Prisons in and for the Province.

- The Establishment, Maintenance, and Management of Hospitals, Asylums, Charities, and Eleemosynary Institutions in and for the Province, other than Marine Hospitals.

- Municipal Institutions in the Province.

- Shop, Saloon, Tavern, Auctioneer, and other Licences in order to the raising of a Revenue for Provincial, Local, or Muni-cipal Purposes.

- Local Works and Undertakings other than such as are of the following Classes,--

- Lines of Steam or other Ships, Railways, Canals, Telegraphs, and other Works and Undertakings connecting the Province with any other or others of the Provinces, or extending beyond the Limits of the Province:

- Lines of Steam Ships between the Province and any British or Foreign Country:

- Such Works as, although wholly situate within the Province, are before or after their Execution declared by the Parliament of Canada to be for the general Advantage of Canada or for the Advantage of Two or more of the Provinces.

- The Incorporation of Companies with Provincial Objects.

- The Solemnization of Marriage in the Province.

- Property and Civil Rights in the Province.

- The Administration of Justice in the Province, including the Constitution, Maintenance, and Organization of Provincial Courts, both of Civil and of Criminal Jurisdiction, and including Procedure in Civil Matters in those Courts.

- The Imposition of Punishment by Fine, Penalty, or Imprisonment for enforcing any Law of the Province made in relation to any Matter coming within any of the Classes of Subjects enumerated in this Section.

- Generally all Matters of a merely local or private Nature in the Province

As you can clearly see, federal and provincial powers of taxation overlap. Both can and do levy taxes.

The Quebec Resolutions you quote were proposals. A framework or draft if you will. Oh, and those same resolutions stated (Resolution 29)

29. The General Parliament shall have power to make Laws for the peace, welfare and good government of the Federated Provinces (saving the Sovereignty of England), and especially laws respecting the following subjects: --

5. The raising of money by all or any other modes or systems of Taxation.

Posted 04 December 2013 - 08:53 AM

Ok fellas, let's not make things personal.

crabbygit's points are valid. The history of taxation as presented by him/her are an interesting addendum to this discussion.

Mike, if the goal of VV is to have "high level discussions", then how can it possibly be considered personal to call somebody out when what they are saying is clearly false? Quality discussions, in my experience anyway, are built upon facts (unless of course we're talking about fiction).

Posted 04 December 2013 - 08:58 AM

Okay Jonny lets discuss these founding documents of Canada which according to you have no basis in law...

This is clearly not what I said. Your claim that the "The Federal [Central] government of Canada has never in its history had the authority to "Direct Tax" the citizens of Canada that privilege is an exclusive right of the provincial legislatures" is bogus, false and has no basis in law. My understanding is confirmed by the courts. Yours is not. If you feel the courts were incorrect in their interpretation, I strongly encourage you to begin legal proceedings.

Posted 04 December 2013 - 08:59 AM

Mike, if the goal of VV is to have "high level discussions", then how can it possibly be considered personal to call somebody out when what they are saying is clearly false? Quality discussions, in my experience anyway, are built upon facts (unless of course we're talking about fiction).

We just ask you to keep the tone civil.

Posted 04 December 2013 - 09:10 AM

Oh lordy, do we have a "Freeman" amongst us now?

TAXES ARE LEGAL.

HST IS LEGAL.

ALIENS DO NOT PROBE HUMAN ANUSES.

THE CIA/CASTRO DID NOT ASSASSINATE PRESIDENT KENNEDY.

9/11 WAS NOT AN "INSIDE JOB".

Posted 04 December 2013 - 09:30 AM

Putting people in concentration camps in 1940s Germany was quite legal but was it lawful?

And thus endeth the "high-level" discussion.

Lake Side Buoy - LEGO Nut - History Nerd - James Bay resident

Posted 04 December 2013 - 09:45 AM

You didn't just compare Nazi Germany concentration camps with a few cents tax on fresh produce, did you?

We're done with the Nazi references.

Posted 04 December 2013 - 12:30 PM

a few cents tax on fresh produce, did you?

Just a minor clarification - grocery items like milk, meat, bread, vegetables and beverages have always been GST/HST "zero rated" (i.e. taxable at a GST rate of 0%). These fall under the CRA category of "basic groceries", which has a very broad definition. If you're really bored, you can read more here: http://www.cra-arc.g...l#_Toc155586101

Edited by jonny, 04 December 2013 - 12:34 PM.

0 members, 0 guests, 0 anonymous users