I’m driving home the point that the data you rely on is incomplete by a considerable margin and only tells of a reality up to a certain point.

Your data won’t capture the sales of dozens of units from just one project over the last two weeks. It also won’t capture their prices, it won’t include them in your median calculations nor the averages. About 50-units just sold in one project and they are completely removed from your narrative.

Couple points on that.

1. Only applies to condos. Not a significant number of new build single family to matter.

2. You are right, no one has this data. So the question is, what is the impact? If the data I use is incomplete, what effect does this have? After all, it only really makes a difference if the addition of presales would change the "narrative" (interesting how you call facts a narrative). I've already pointed out that presales and resales are substitutes for each other so the two markets follow each other. So I am very confident even if the data were available it wouldn't change the overall picture which is that the market has cooled down. If you would like to disprove that by giving an example of when the presale market took off while the resale market cooled, or vice versa, then by all means go ahead.

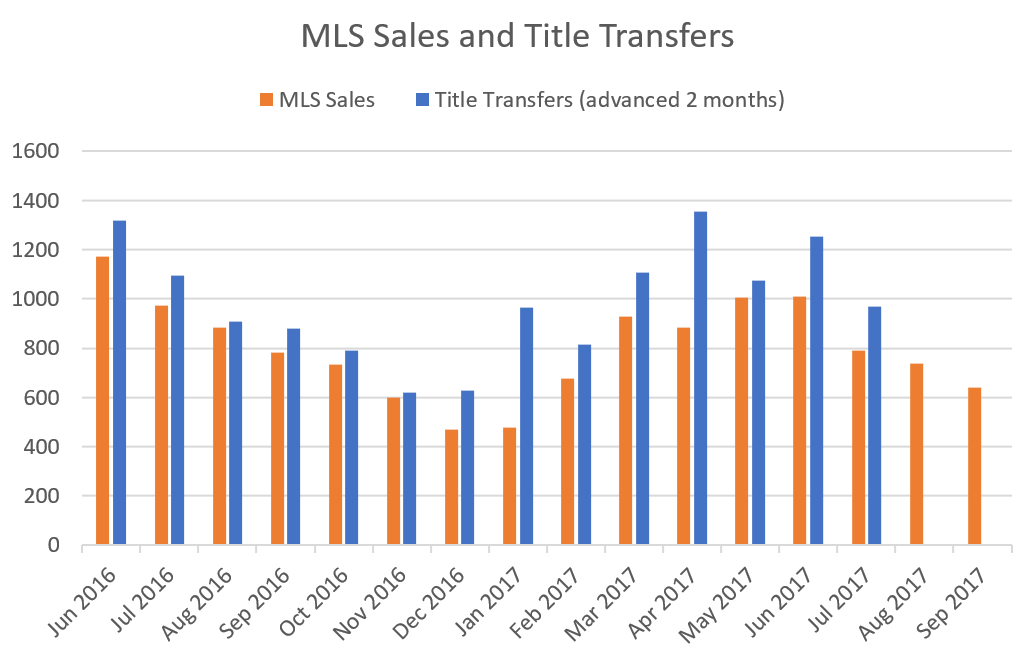

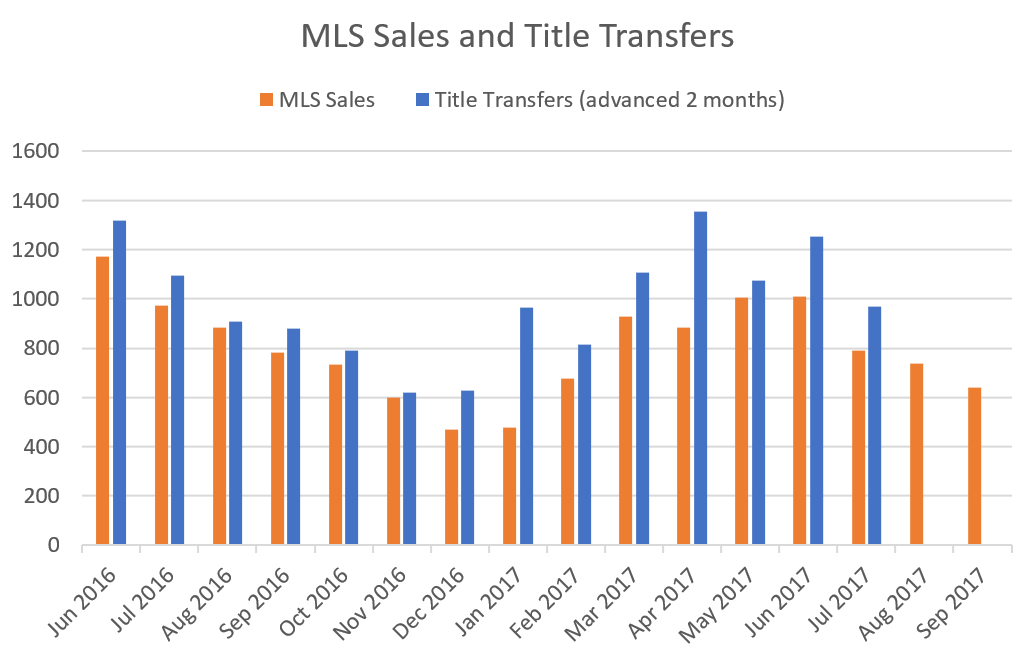

By the way, we can quantify how many property transfers are missing from the MLS database by comparing MLS transactions to those registered at the land title office.

In a year about 81% of sales happened on MLS, with 19% outside of that. The 19% is made up of pre-sales, private sales, inheritances, etc.

Edited by LeoVictoria, 11 August 2018 - 07:03 AM.