So then that whole thing re: staging a house for sale isn't such a big deal after all?

Victoria's housing market, home prices and values

#1901

Posted 18 September 2017 - 08:40 AM

#1902

Posted 18 September 2017 - 08:44 AM

So then that whole thing re: staging a house for sale isn't such a big deal after all?

Not near as much in the market we've had the past 2 years... still, it can make a difference in your final sale price.

#1903

Posted 18 September 2017 - 11:12 AM

So then that whole thing re: staging a house for sale isn't such a big deal after all?

It does and it doesn't. I don't know about most buyers but we can see past what's in the house (or not) and look at the important things like the structure and condition. I try to focus on what can't be changed (the property, the neighbourhood, the general lay-out of the house) and gloss over the fixable stuff (finishes, age of windows, etc).

I will say that walking into a cluttered (or smelly) house is a turn off though and can cloud the judgement of the potential buyer in a negative way. One house we went into was ankle deep in dog hair and although that could be easily cleaned up, it was truly disgusting and I couldn't get out of there fast enough. On the same topic, piles of dog crap in the yard should ALWAYS be removed before an open house or a showing. What are the sellers and the seller's agent thinking when they overlook simple to fix stuff like this?

- jonny likes this

#1904

Posted 18 September 2017 - 11:40 AM

^ if you watch HGTV at all, there are a lot of people who can't get past a home that doesn't have granite counter tops or something else easily fixable.

- jonny, johnk and Midnightly like this

#1905

Posted 18 September 2017 - 12:10 PM

^ if you watch HGTV at all, there are a lot of people who can't get past a home that doesn't have granite counter tops or something else easily fixable.

I always laugh at the folks who won't consider a property because they don't like the paint colours. Is there anything more easily changeable than paint?

- qwerty and johnk like this

#1906

Posted 18 September 2017 - 01:25 PM

You guys do know those shows are scripted right?

- VicHockeyFan likes this

#1907

Posted 01 October 2017 - 01:00 PM

Interesting description for this property: "Leo Jiao, MBA, Asian marketing specialist, Mandarin and English service, Integrated listing/marketing/communication package for sellers."

#1908

Posted 02 October 2017 - 09:16 AM

Inventory slump keeps Victoria's third quarter real-estate sales suppressed

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1909

Posted 02 October 2017 - 12:14 PM

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1910

Posted 17 October 2017 - 06:10 AM

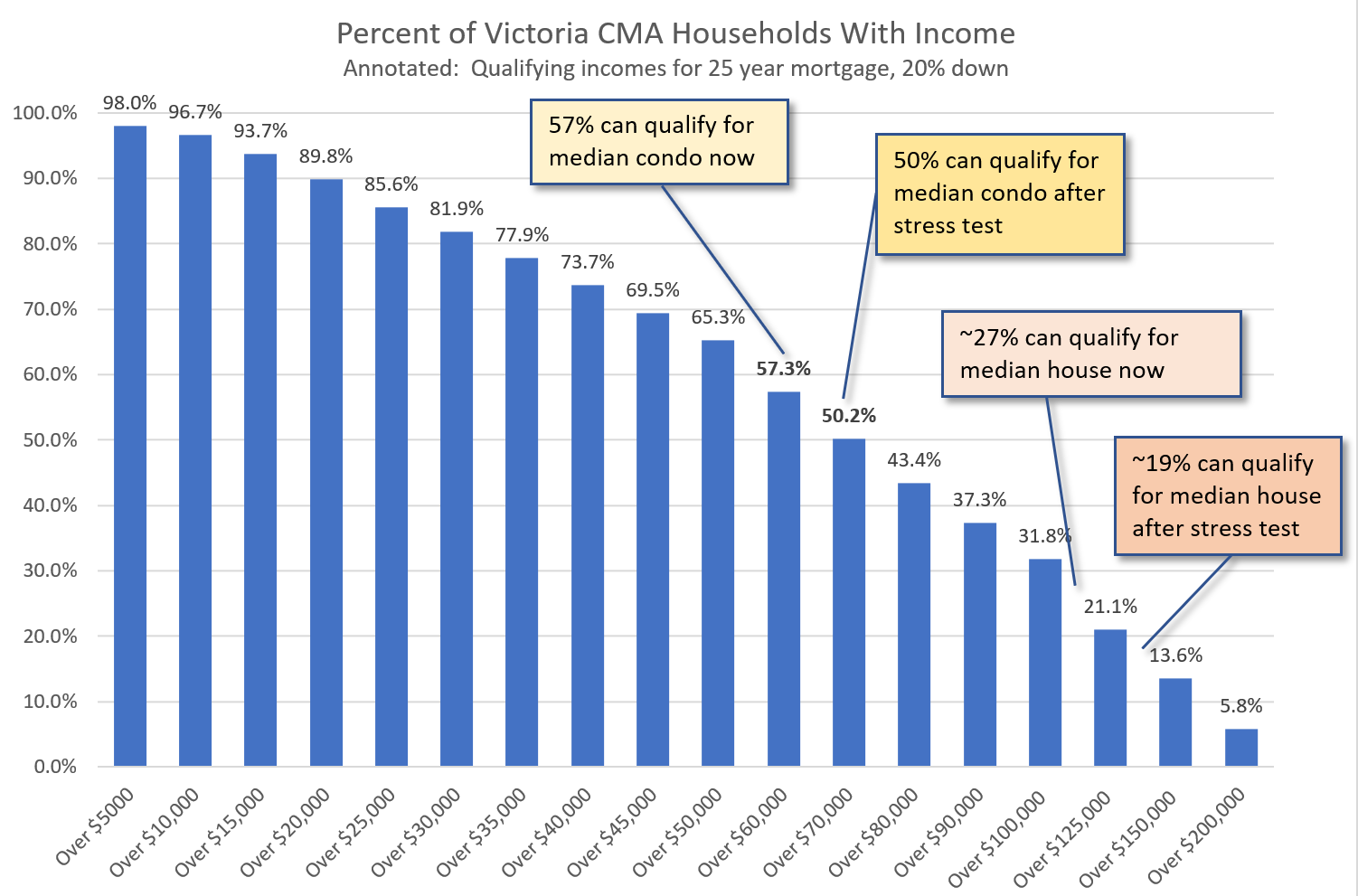

The new stress test could sideline quite a lot of buyers in Victoria. Biggest change to credit availability in years.

Article: https://househuntvic...17/stress-test/

Previous coverage of the stress test: https://househuntvic...5/stressed-out/

#1911

Posted 17 October 2017 - 06:34 AM

But the stress test will force more buyers into townhomes and condos. People won’t stop buying with credit (still) as cheap as it is.

- Matt R. likes this

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1912

Posted 17 October 2017 - 07:17 AM

Oh, and we're also likely to see listings grow as people realize now is the time to sell their SFD and downsize. Expect to see inventory finally scale up in 2018, and it's about time.

The situation right now is slim pickings and sellers are pushing for (too often) outrageous asking prices, sometimes 75% above the assessed value. I mean there's some wriggle room there, for sure, but c'mon...

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1913

Posted 17 October 2017 - 08:56 AM

Oh, and we're also likely to see listings grow as people realize now is the time to sell their SFD and downsize. Expect to see inventory finally scale up in 2018, and it's about time.

The situation right now is slim pickings and sellers are pushing for (too often) outrageous asking prices, sometimes 75% above the assessed value. I mean there's some wriggle room there, for sure, but c'mon...

I certainly hope so. Wouldnt want to have to ask for a posting to Halifax so I could get a 3 bed house for less than 800k.

- jonny and Citified.ca like this

#1914

Posted 17 October 2017 - 10:12 AM

And here we go!

http://victoria.citi...s-test-in-2018/

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1915

Posted 17 October 2017 - 10:32 AM

I obviously don't want a housing crash, but I am totally fine with a noticeable pullback and some long-term price stability.

#1916

Posted 17 October 2017 - 10:45 AM

It'll also cut down on inventory standing still because the seller has the grand idea that their home is worth 1.5x its actual tangible value even in this market. There's quite a bit of that happening out there.

- jonny likes this

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#1917

Posted 17 October 2017 - 05:05 PM

^but the same could also be said about rental prices too

- Chris City likes this

#1918

Posted 17 October 2017 - 08:47 PM

"Provincial credit unions, however, are expected to follow through with a similar requirement although the date by which they mandate blanket stress tests is anticipated approximately 30-to-90 days into 2018."

Where did you hear this?

#1919

Posted 17 October 2017 - 08:50 PM

"Provincial credit unions, however, are expected to follow through with a similar requirement although the date by which they mandate blanket stress tests is anticipated approximately 30-to-90 days into 2018."

Where did you hear this?

Globe and Mail:

Most credit unions in Canada are provincially regulated and not covered by OSFI's rules, but some credit-union systems are federally regulated. CCUA said provincial regulators also look at OSFI's standards when updating their underwriting rules.

https://beta.theglob...obeandmail.com

#1920

Posted 17 October 2017 - 09:16 PM

Hmm. I don't see where it says anything about FICOM changing their underwriting rules 30 to 90 days after the OSFI regs come into effect. I don't believe that FICOM instituted any stress testing last year after OSFI rolled theirs out. CU's are more conservative in general though.

Edited by LeoVictoria, 17 October 2017 - 09:21 PM.

- VicHockeyFan likes this

Use the page links at the lower-left to go to the next page to read additional posts.

0 user(s) are reading this topic

0 members, 0 guests, 0 anonymous users