Mine are up about $500. A bit over 10%. What a pity, I was so looking forward to paying out some reconciliation money. I guess it will have to wait until next year.

Municipal Property Taxes

#281

Posted 19 May 2022 - 07:07 AM

#282

Posted 19 May 2022 - 07:16 AM

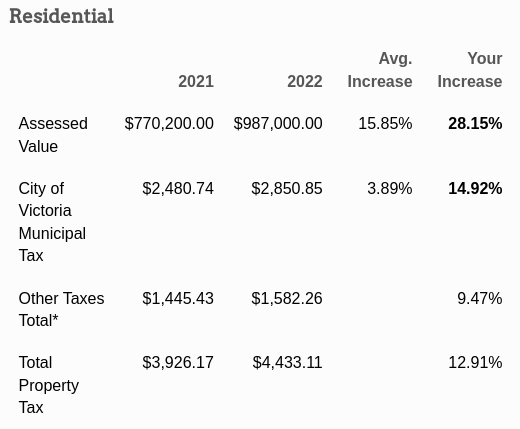

basically what we used to call the "mill rate" dropped 12% from 5.1 to 4.5

but the assesessed value went up by 28% (sadly i can't eat, or spend, equity)

so tax increase is 12.8%

(numbers are a little off because of sewage charge - but close enough)

Funny how that happens. City claims "average" tax increase is 3.8% but everyone seems to be up 10%+

#283

Posted 19 May 2022 - 09:15 AM

Funny how that happens. City claims "average" tax increase is 3.8% but everyone seems to be up 10%+

i guess as far as the CoV is concerned, - I am "above average!"

fool that i am, i will take that as a compliment ;-)

#284

Posted 19 May 2022 - 03:31 PM

My Assessment went up 10% and for the first time in history my taxes lowered by like 2.2% That's got to be wrong...

#285

Posted 19 May 2022 - 03:47 PM

Funny how that happens. City claims "average" tax increase is 3.8% but everyone seems to be up 10%+

Mine was down 2%*. Perhaps this is how the CoV worked out its figure.

*keep in mind that I was gifted with 3 homeless shelters in fewer than 3 blocks over the past year

#286

Posted 19 May 2022 - 03:48 PM

My Assessment went up 10% and for the first time in history my taxes lowered by like 2.2% That's got to be wrong...

That means the average assessments in the CoV went up significantly higher than your 10%, lowering your tax burden.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#287

Posted 19 May 2022 - 05:03 PM

Mine was down 2%*. Perhaps this is how the CoV worked out its figure.

*keep in mind that I was gifted with 3 homeless shelters in fewer than 3 blocks over the past year

I guess there's an advantage to living next to those shelters after all!

- Matt R. likes this

#288

Posted 19 May 2022 - 05:10 PM

I guess there's an advantage to living next to those shelters after all!

I'll have to get back to you on that after our next break-in, which I am sure will be any day now.

#289

Posted 19 May 2022 - 05:20 PM

That’s up from $31k and $16k.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#290

Posted 19 May 2022 - 05:30 PM

#291

Posted 19 May 2022 - 07:17 PM

I'm deferring my taxes, that way when the home equity tax comes in I will owe less.

- Nparker likes this

#292

Posted 19 May 2022 - 10:51 PM

My Assessment went up 10% and for the first time in history my taxes lowered by like 2.2% That's got to be wrong...

in CoV mill rate dropped from 5.1 to 4.5 or 12%, so if your assessment goes up less than 12% you pay less, assessment up more than 12% you pay more

for an approximation, take your assessment increase, add 1 and multiply by 0.88 for an estimate of tax increase/decrease percentage

in my case a 28% assessment increase means - (1 + 0.28) * 0.88 = 1.126 or 12.6%

#293

Posted 19 May 2022 - 10:57 PM

in CoV mill rate dropped from 5.1 to 4.5 or 12%, so if your assessment goes up less than 12% you pay less, assessment up more than 12% you pay more

for an approximation, take your assessment increase, add 1 and multiply by 0.88 for an estimate of tax increase/decrease percentage

in my case a 28% assessment increase means - (1 + 0.28) * 0.88 = 1.126 or 12.6%

in the CoV - if you have your folio number this helpful website is very handy - https://www.victoria...calculator.html

it pointed out that my CoV tax hike was actually closer to 15%, while other taxes increased just 9.5%

#294

Posted 20 May 2022 - 07:27 AM

That means the average assessments in the CoV went up significantly higher than your 10%, lowering your tax burden.

Yeah I get that...

in CoV mill rate dropped from 5.1 to 4.5 or 12%, so if your assessment goes up less than 12% you pay less, assessment up more than 12% you pay more

for an approximation, take your assessment increase, add 1 and multiply by 0.88 for an estimate of tax increase/decrease percentage

in my case a 28% assessment increase means - (1 + 0.28) * 0.88 = 1.126 or 12.6%

Ah yes.

Edited by Ismo07, 20 May 2022 - 07:27 AM.

#295

Posted 20 May 2022 - 07:35 AM

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#296

Posted 20 May 2022 - 07:43 AM

So why’s it got to be wrong?

I was just referring to taxes lowering. I'm not sure I have ever experienced that. It was more of an expression rather than actual disbelief.

- Mike K. likes this

#297

Posted 20 May 2022 - 07:56 PM

It's a good thing I'm deferring, my taxes are up 18.5%.

Edited by LJ, 20 May 2022 - 07:59 PM.

#298

Posted 08 June 2022 - 11:10 PM

#299

Posted 09 June 2022 - 05:49 AM

If the mill rate for Victoria property taxes decreased by 12 % and my assessed property value increased by 22% from last year.....didn't the city of Victoria just receive an increase of 10% +- in dollars? Imagine the impact on total revenue across the city.

What am I missing?

#300

Posted 09 June 2022 - 05:54 AM

Edited by Victoria Watcher, 09 June 2022 - 05:54 AM.

- Ismo07 likes this

Use the page links at the lower-left to go to the next page to read additional posts.

2 user(s) are reading this topic

0 members, 2 guests, 0 anonymous users