Affordable housing in Victoria

#3741

Posted 09 October 2024 - 06:29 PM

#3742

Posted 09 October 2024 - 07:22 PM

We don't know that, we just know the birthrate is low.

#3743

Posted 09 October 2024 - 07:32 PM

Alcoholism!

Well after a while yeah, the immediate repercussions can be a little more acute.

#3744

Posted 28 October 2024 - 06:46 AM

Conservative Leader Pierre Poilievre said he would remove Canada’s 5% national sales tax on new homes sold for under C$1 million ($719,700) if he’s elected prime minister.

Poilievre, whose party leads by about 20 points in recent polls, said the cut would save around C$2,200 a year in mortgage payments on a C$800,000 house.

https://www.bloomber...-many-new-homes

Edited by Victoria Watcher, 28 October 2024 - 06:46 AM.

- lanforod likes this

#3747

Posted 12 November 2024 - 07:11 AM

Add to that immigration, and you’d have enough demand to sustain condos, even. But here’s the rub. Canadians cannot afford $450k 1BR condos as starter homes (without parking). By and large, that’s unattainable what should be entry level housing. You may have a great job, but unless you’re with a partner, or you have parents with money, you’re not buying a new entry level condo at today’s prices. All said and done, at today’s mortgage rates, and today’s taxes, you’re at around $2,000-$2,100 in monthly expenses for that unit, provided you had $90k down, plus closing costs. That means your monthly income has to be at around $6k, or $72k/year, and you would need that $90k. Not a lot of kids leaving university with a salary anywhere near that, let alone the ability to save about $20k/year for five years. It also makes it a challenge for investors. Couple the taxes on ‘flipping’ and the market for investor-owned condos has dried up as well.

So there’s why building is down 19%. And there are plenty of other factors working against the delivery of housing.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#3748

Posted 12 November 2024 - 07:47 AM

- Mike K., Matt R. and Victoria Watcher like this

#3749

Posted 12 November 2024 - 10:14 AM

#3750

Posted 12 November 2024 - 04:10 PM

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#3751

Posted 12 November 2024 - 05:46 PM

That’s with no other debt. What are the odds of that? Car? Student loans? Credit cards?

I am so grateful my partner taught our kids financial literacy. They’ll be finished their degrees with money in the bank, a really strong head start on adulthood.

- Barrister likes this

#3752

Posted 12 November 2024 - 06:56 PM

Now get them to put away $50/week. By the time they’re 30, that money, if they’re 21 years old, will = to $25k at 3% interest, if compounded monthly.

If they can put away $300/month by the time they’re 25, that will grow to $31,500 by 30.

- Matt R. likes this

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#3753

Posted 12 November 2024 - 07:30 PM

#3754

Posted 18 November 2024 - 05:56 AM

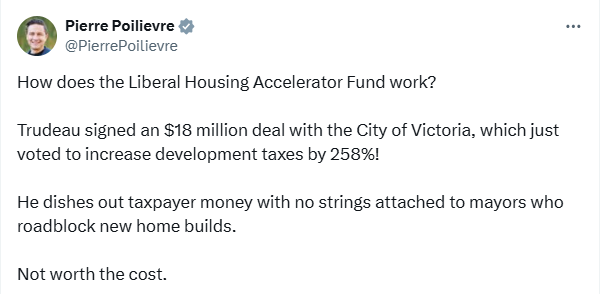

The City of Victoria is proposing a 258% DCC increase from $6,871.19 to $24,582.06 for low density residential. For townhomes, duplexes etc the increase is 133% from $6,238.90 to $14,529.66.

The city’s report says their consultation involved “12 participants, in addition to City staff and consultants.”

There were no invitations to hundreds of local builders impacted by this enormous increase adding to costs of homebuyers. The Best Practices Guide says there “must” be opportunities for meaningful and informed input.

DCC increases of up to 258% are clearly “excessive,” “deter development” and “discourage construction of reasonably priced housing.”

Add these costs to the CRD’s plan for DCC water charges of $9,045 per new single family home and $7,914 to townhomes, duplexes, etc.

https://www.vrba.ca/...ds-enforcement/

Edited by Victoria Watcher, 18 November 2024 - 05:56 AM.

#3755

Posted 18 November 2024 - 07:03 AM

I think it’s clear to us observers on the sidelines that something is very broken.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#3756

Posted 18 November 2024 - 07:19 AM

#3757

Posted 18 November 2024 - 07:20 AM

In this report:

https://pub-victoria...ocumentId=94403

How do you think the consultant went about choosing these communities for the comparison?

#3758

Posted 18 November 2024 - 07:24 AM

#3759

Posted 18 November 2024 - 07:25 AM

#3760

Posted 18 November 2024 - 07:26 AM

Businesses strive to be competitive, and the lower their costs, the more competitive they can be. But when they raise their prices because they can, relative to their competitors, we consider that collusion or price fixing.

When governments raise their fees because they see other municipalities charging more, we do not consider that collusion or price fixing.

If Victoria is charging less than others, why must it now charge more? What is the business case for that increase, aside from ‘because we can?’

Why do businesses get in trouble for raising prices as a block, but governments do not?

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

Use the page links at the lower-left to go to the next page to read additional posts.

2 user(s) are reading this topic

0 members, 2 guests, 0 anonymous users