Victoria's housing market, home prices and values

#101

Posted 06 October 2012 - 06:02 PM

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#102

Posted 07 October 2012 - 01:01 PM

According to the latest data from Will Dunning, Chief Economist of CAAMP, less than 4 in 10 buyers have 20% down payments.

For those purchasing from 2010 through spring 2012:

41% had less than a 10% down-payment

21% had a 10-19.99% down-payment

Only 39% put down 20% or more.

From: Insured Buyers are the Majority

And that's all buyers!

#103

Posted 07 October 2012 - 01:21 PM

From: Insured Buyers are the Majority

And that's all buyers!

Of course, you can avoid insurance altogether by plopping down 20% or more. The challenge is, only a minority of buyers have that sort of equity.

According to the latest data from Will Dunning, Chief Economist of CAAMP, less than 4 in 10 buyers have 20% down payments.

For those purchasing from 2010 through spring 2012:

41% had less than a 10% down-payment

21% had a 10-19.99% down-payment

Only 39% put down 20% or more.

(This survey included both first-time and repeat buyers. First-time buyers accounted for 56% of the dataset. Totals don’t add to 100% due to rounding.)

There is perhaps a fair amount of buyers that HAVE the 20%, but decide not to use it all.

If their mortgage is 3.9% but they have other investments that regularly pay 8%, why would you stick all that equity in your home?

#104

Posted 07 October 2012 - 02:13 PM

There is perhaps a fair amount of buyers that HAVE the 20%, but decide not to use it all.

If their mortgage is 3.9% but they have other investments that regularly pay 8%, why would you stick all that equity in your home?

+1 - I had approximately 50% when I completed on my condo last year but I only put down 20% - with my RBC variable mortgage in the low 2% why would I put down more? I have investments in TRP, BMO, Rogers......all pay more than 2% dividend.

Marko Juras, REALTOR® & Associate Broker | Gold MLS® 2011-2023 | Fair Realty

www.MarkoJuras.com Looking at Condo Pre-Sales in Victoria? Save Thousands!

#105

Posted 07 October 2012 - 03:50 PM

+1 - I had approximately 50% when I completed on my condo last year but I only put down 20% - with my RBC variable mortgage in the low 2% why would I put down more? I have investments in TRP, BMO, Rogers......all pay more than 2% dividend.

But you still put down 20%. Not many people with the resources will be wanting to pay the CMHC fees if they can avoid it.

I doubt there are a significant number of people that are keeping money back and only putting 10% or less down.

#106

Posted 07 October 2012 - 04:13 PM

Marko Juras, REALTOR® & Associate Broker | Gold MLS® 2011-2023 | Fair Realty

www.MarkoJuras.com Looking at Condo Pre-Sales in Victoria? Save Thousands!

#107

Posted 07 October 2012 - 06:16 PM

The one thing I notice with my 5 to 10 down percent buyers here in Victoria is that they typically have huge incomes to qualify at these price. I've had a single individual earning 180k per year in a very secure job buy with 5% down.

Because he was dying to pay the CMHC premiums on 95% (2.75% of total).

#108

Posted 07 October 2012 - 08:22 PM

Because he was dying to pay the CMHC premiums on 95% (2.75% of total).

No, just saying, those putting down 5% in Victoria due to prices typically need big incomes to qualify. In this situation the buyer only had 5% down. I don't think anyone pays CMHC for fun.

Marko Juras, REALTOR® & Associate Broker | Gold MLS® 2011-2023 | Fair Realty

www.MarkoJuras.com Looking at Condo Pre-Sales in Victoria? Save Thousands!

#109

Posted 07 October 2012 - 08:37 PM

No, just saying, those putting down 5% in Victoria due to prices typically need big incomes to qualify. In this situation the buyer only had 5% down. I don't think anyone pays CMHC for fun.

Exactly. So damn near 6 of 10 people don't put down 20% not because they choose to invest their money elsewhere, but because they don't have the money. Your 180k client is by far the exception amongst those with no money.

#110

Posted 07 October 2012 - 09:37 PM

Exactly. So damn near 6 of 10 people don't put down 20% not because they choose to invest their money elsewhere, but because they don't have the money. Your 180k client is by far the exception amongst those with no money.

Most of my buyers put down 20% or more and I always have a few clients per year paying all cash.

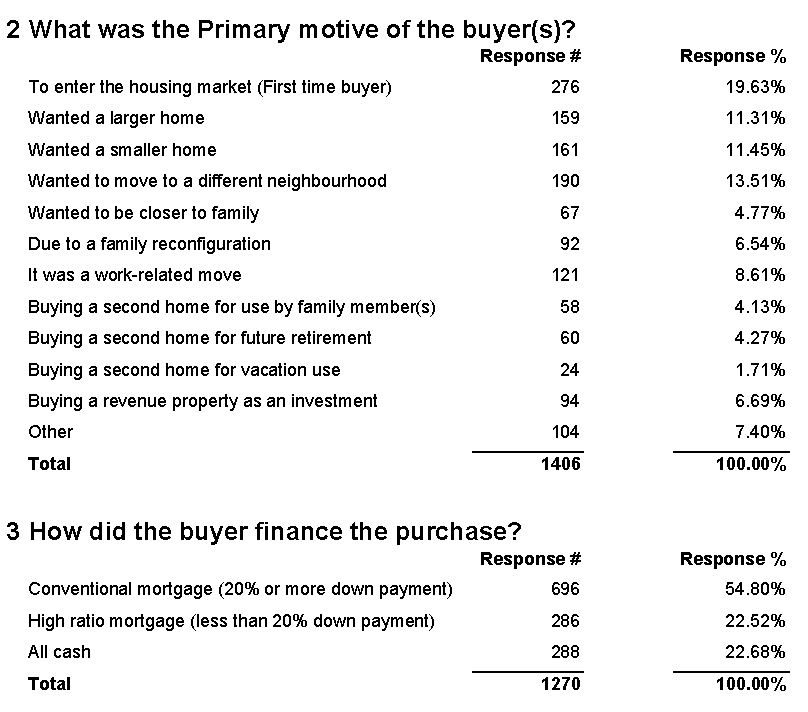

This is from a 2011 VREB survey....

Marko Juras, REALTOR® & Associate Broker | Gold MLS® 2011-2023 | Fair Realty

www.MarkoJuras.com Looking at Condo Pre-Sales in Victoria? Save Thousands!

#111

Posted 07 October 2012 - 10:25 PM

I also don't see much reason to put any more than 20% down at this point when the mortgage is 2.99%.

#112

Posted 07 October 2012 - 10:57 PM

#113

Posted 08 October 2012 - 07:14 AM

Most of my buyers put down 20% or more and I always have a few clients per year paying all cash.

This is from a 2011 VREB survey....

Interesting. I've seen these before but it's odd that the stats would be so wildly at odds with national ones. The key difference here is the percentage of first time home buyers. For the CAAMP survey, 56% were first timers, while apparently in Victoria last year it was only 20%. I have heard elsewhere that first timers generally make up about half of the market.

So is that the key to our slow market these last two years? First timers just aren't buying anymore. Do you know when this VREB survey for 2012 comes out?

#114

Posted 08 October 2012 - 07:46 AM

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#115

Posted 08 October 2012 - 07:47 AM

Interesting. I've seen these before but it's odd that the stats would be so wildly at odds with national ones.

No it's not. Real estate is local. Taking national statistics and assuming Victoria should conform to them is absurd.

#116

Posted 08 October 2012 - 07:49 AM

Many newcomers to the Island arrive with cash in hand from real-estate sales elsewhere. I can see how this would nudge up our ratio of 20%+ down payments and cash buys much higher than what may be happening elsewhere in this country.

Yes, and almost every down-sizer presumably has an all-cash deal happening. Mom and dad sell their 1965 Gordon head home, that they bought for $17,000 (in 1965), get $600k for it and buy a two-bed townhouse for $300,000.

#117

Posted 08 October 2012 - 08:26 AM

No it's not. Real estate is local. Taking national statistics and assuming Victoria should conform to them is absurd.

Nonsense. The stats differ so you look harder at what might be the cause.

And sure enough I didn't have to look far at all to discover it.

Only 20% of Victoria buyers in 2011 were first timers, compared to 56% in the national survey, which explains the difference in down payment stats.

I prefer to move beyond hand waving platitudes like "real estate is local" and get real answers.

#118

Posted 08 October 2012 - 08:50 AM

I suppose the best way to describe it is these folks are lined up at the starting line of a marathon eager to start the race, but none of them knows when, or if, the race will even begin. And it's that tension that's weighing on them.

Know it all.

Citified.ca is Victoria's most comprehensive research resource for new-build homes and commercial spaces.

#119

Posted 08 October 2012 - 09:35 AM

Among my acquaintances (most of whom would fall into the 1st time buyer category) who are looking for a home there is more tension than I think I've ever sensed. On the one hand they want to buy while rates are so low and lots of pre-sale inventory is on the market, but on the other hand they are scared that if the market takes a hit they may lose their jobs or face tough financial times, nevermind the fact that home values may also take a significant hit.

I suppose the best way to describe it is these folks are lined up at the starting line of a marathon eager to start the race, but none of them knows when, or if, the race will even begin. And it's that tension that's weighing on them.

I think that is true in so many more areas than just real estate. Its why its so hard to predict the future of the economy right now. The problem is as soon as it becomes clear which side of the argument is right, it will be too late to capitalize on the prediction. In the same light, because each scenario is so incredibly different, the time you spend on the sideline while nothing changes (its been 5 years now) is time you could be paying off your house.

And before someone comes in and says "ya well im saving xx per month by renting and saving/investing that for my eventual house purchase", I will just disclaim it is my opinion forced saving through loan repayments @ 3% is more effective than voluntarily living below your means. Most people cant do that.

#120

Posted 08 October 2012 - 10:55 AM

And before someone comes in and says "ya well im saving xx per month by renting and saving/investing that for my eventual house purchase", I will just disclaim it is my opinion forced saving through loan repayments @ 3% is more effective than voluntarily living below your means. Most people cant do that.

I think for a large amount of people this is a very true, and often overlooked, side of the buy:rent debate.

Use the page links at the lower-left to go to the next page to read additional posts.

1 user(s) are reading this topic

0 members, 1 guests, 0 anonymous users