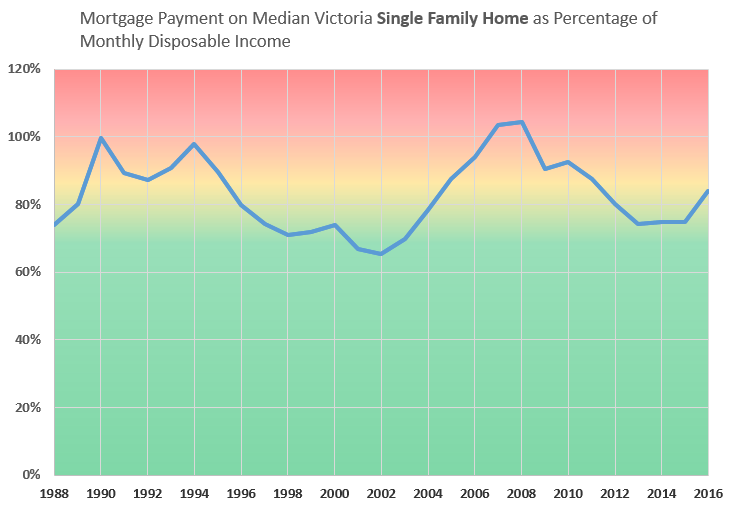

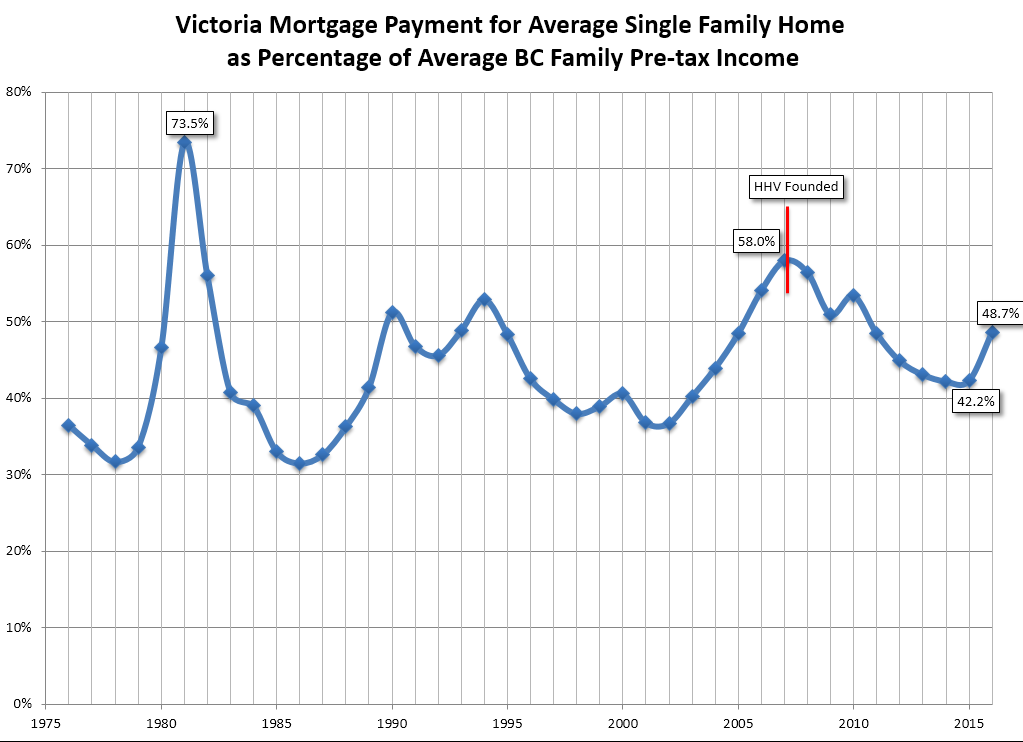

As a twenty-something interesting in buying my first home, I had to stop lurking and sign up to chime in. With the new mortgage rules, any of us looking to buy with less than 20% down are subjected to a stress test against the Bank of Canada's posted rate (around 4.5%, I believe). Assuming my partner and I were making the average family income in Victoria, we still wouldn't be able to buy a home in the price range of a single family house. If a mortgage at the actual rates I could get were going to consume nearly half my income, a mortgage at the Bank of Canada's rate is way over what lenders would approve for me.

That's not taking into account that my partner and I are not making the average family income. I have a great job, but for various reasons my partner's income is significantly lower.

For dual income earners, a single family home is unaffordable. For single income earners and those of us somewhere in between, even most two bedroom condos are unaffordable. I'm not that much worse off financially than my parents were at my age, so why did I get to grow up in a four bedroom house, when my future kids are going to be sharing our condo's only bedroom while my partner and I sleep in a murphy bed in the living room?

Okay, rant (and coffee break) over. My basic point is that even $500/sq foot is absurd for any young person hoping to have a family.

Things have certainly changed one question for you was your parents four bedroom house their first purchase or did they work up to that ?

Did they scrimp and save to afford it ,how was their income ?

Was it in an ideal location or was it more affordable than prime location, how long did they save for it ?

This example might be a little before your time .

Other things have changed too take a funnel look out the small end that's what people used to spend their money on utilities,land lines ,small basic cable bills entertaining at home saving for things you want less credit debt, less stuff period.

Now turn the funnel around it and look at everything people feel they need to be happy.

Add skyrocketing utilities Internet fees ,how many cel phones in one family ,everything is magnified add to that high rents, make hard to save for a down payment.

More stuff ,more credit .

I feel for you .

If you really want to buy start thinking how to achieve it .

Think of ways to cut your spending and up your income .

Extra work, less bills , foreign exchange students if you have the room ,buying a house with a suite live in the suite yourself pay down the principal for a short period of time .

A sound house that needs lots of updates.

A location with a commute to work .

It all depends on what is an expectable trade off to you to own a home .

It doesn't have to be your forever home it gets you in the market.

I've walked in your shoes right down to not qualifying.

It's hard I know .

Ask questions figure out how to achieve your goals .

Check out mortgage brokers.

In the end you have to question whether you want to put in extra effort to own .

It might be harder for you to wrap your head around this coming from a place of a four bedroom house .

Good luck .